Germany’s tax framework provides highly attractive advantages for real estate investors, particularly for high-income expatriates.

Through strategic mechanisms such as Abschreibung (depreciation allowances), interest deductibility, and other property-related expense write-offs, a significant portion of your investment can be offset against taxable income.

For top earners, this can translate into tax savings of €30,000–€55,000 over the first decade, capital that would otherwise be lost to the state. Instead, these savings are redirected into tangible assets that appreciate in value, effectively transforming a tax liability into a compounding wealth engine within one of Europe’s most regulated and resilient property markets.”

Into Wealth USING GERMAN REAL ESTATE

Into Wealth USING GERMAN REAL ESTATE

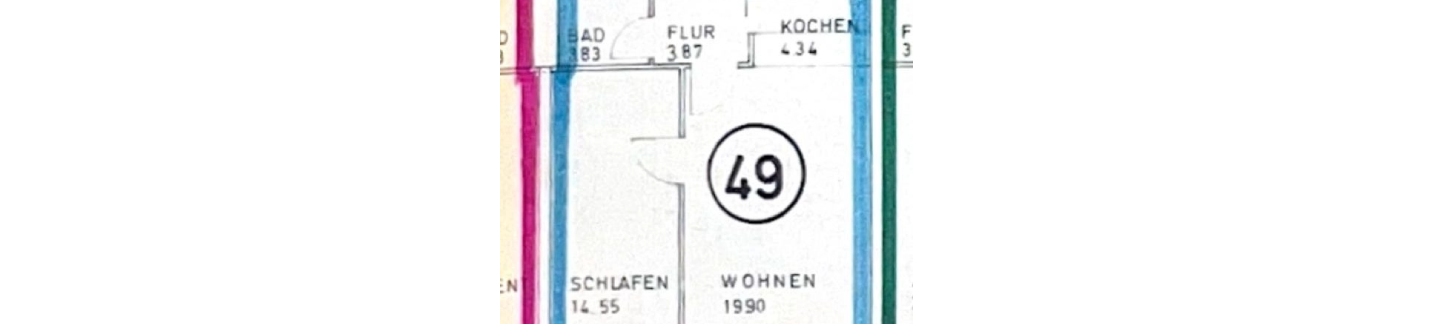

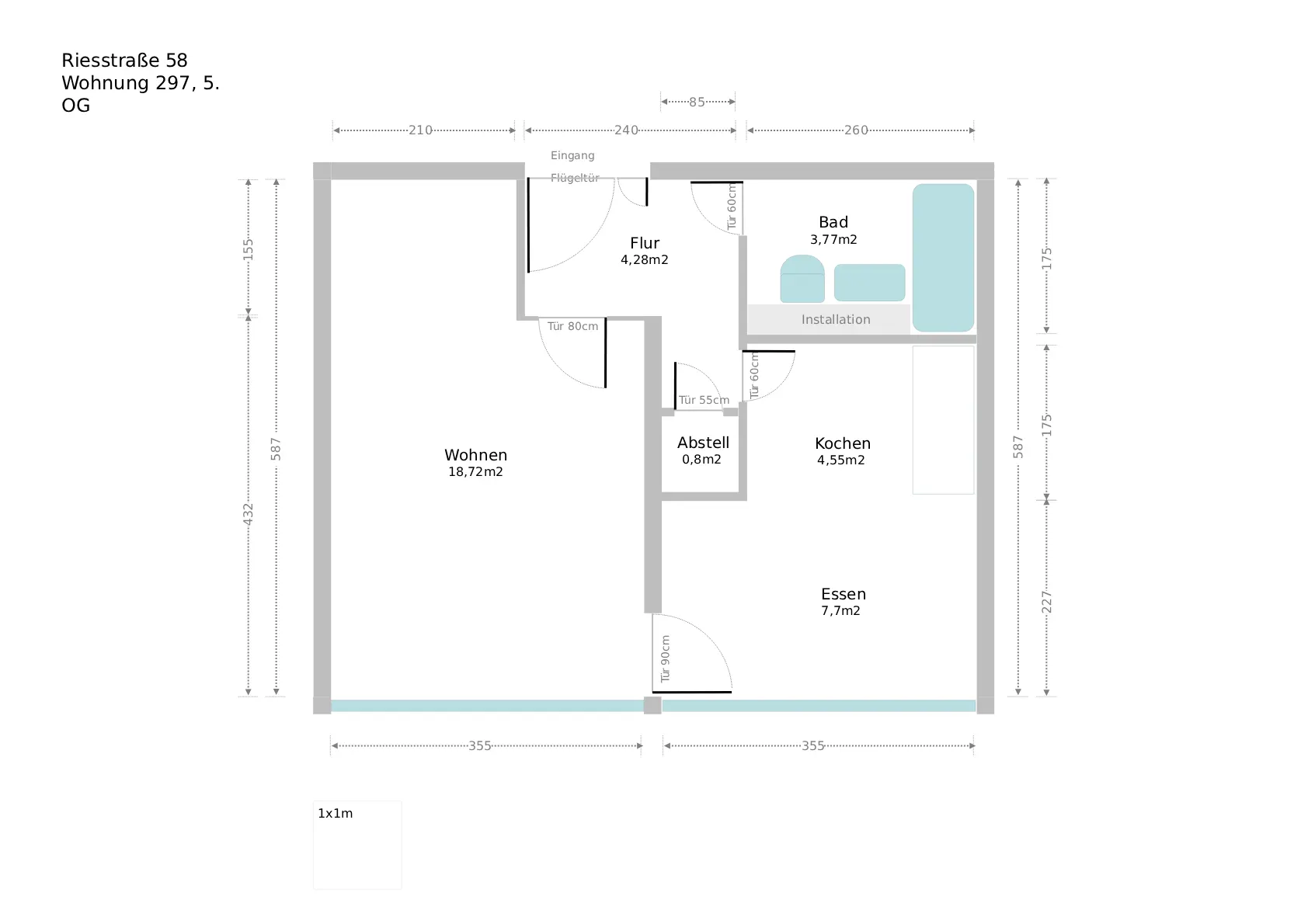

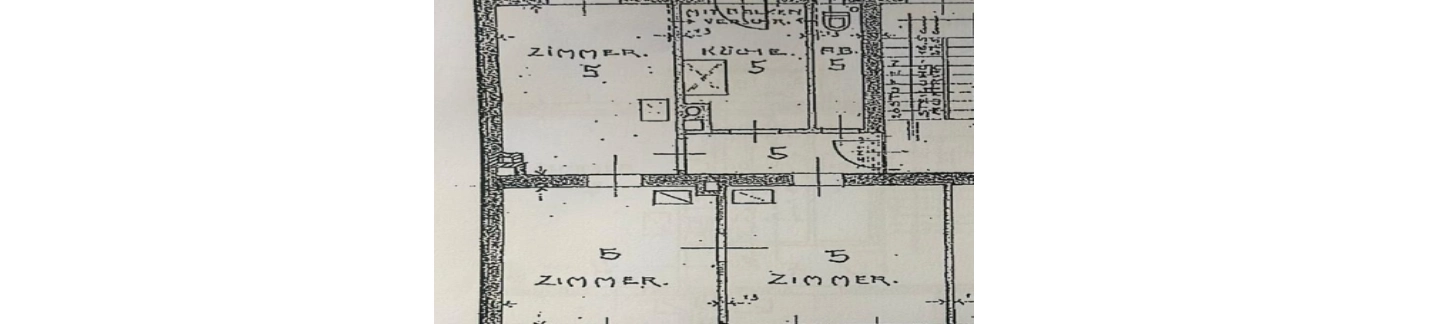

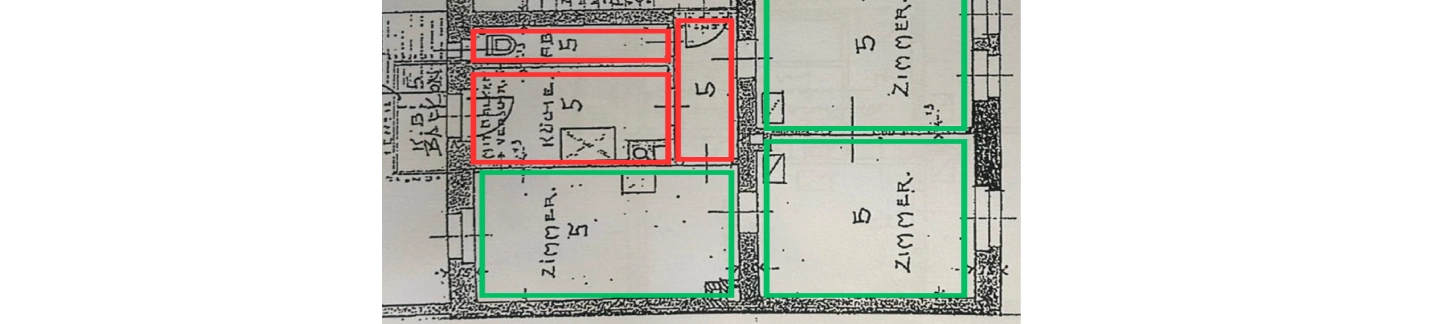

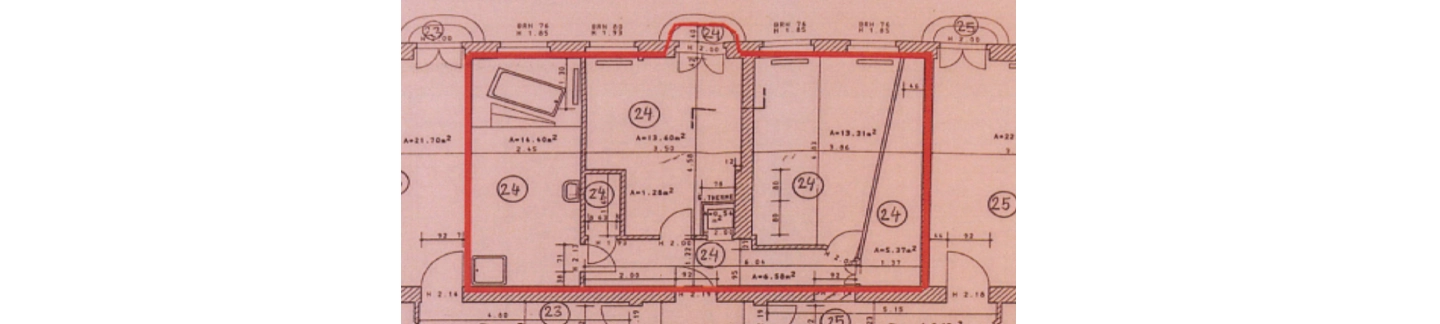

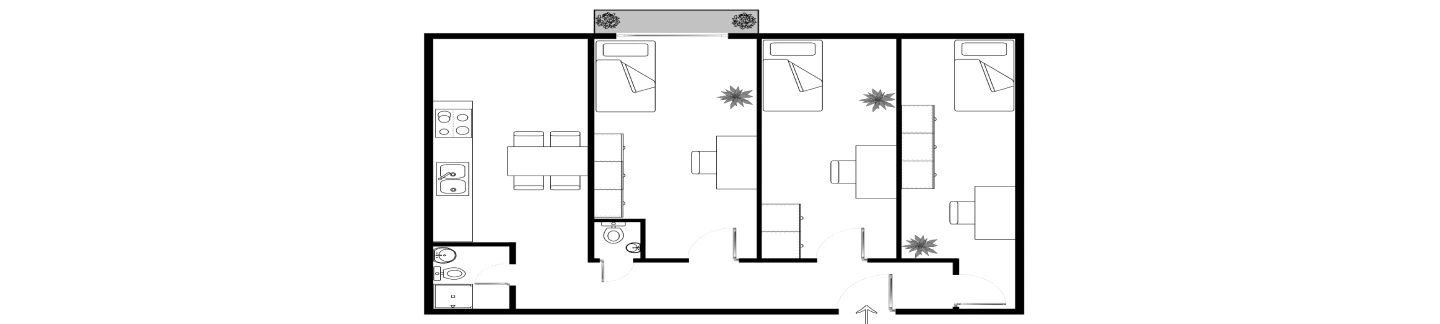

63SQM

63SQM

2 bathrooms

2 bathrooms  4 bedrooms

4 bedrooms

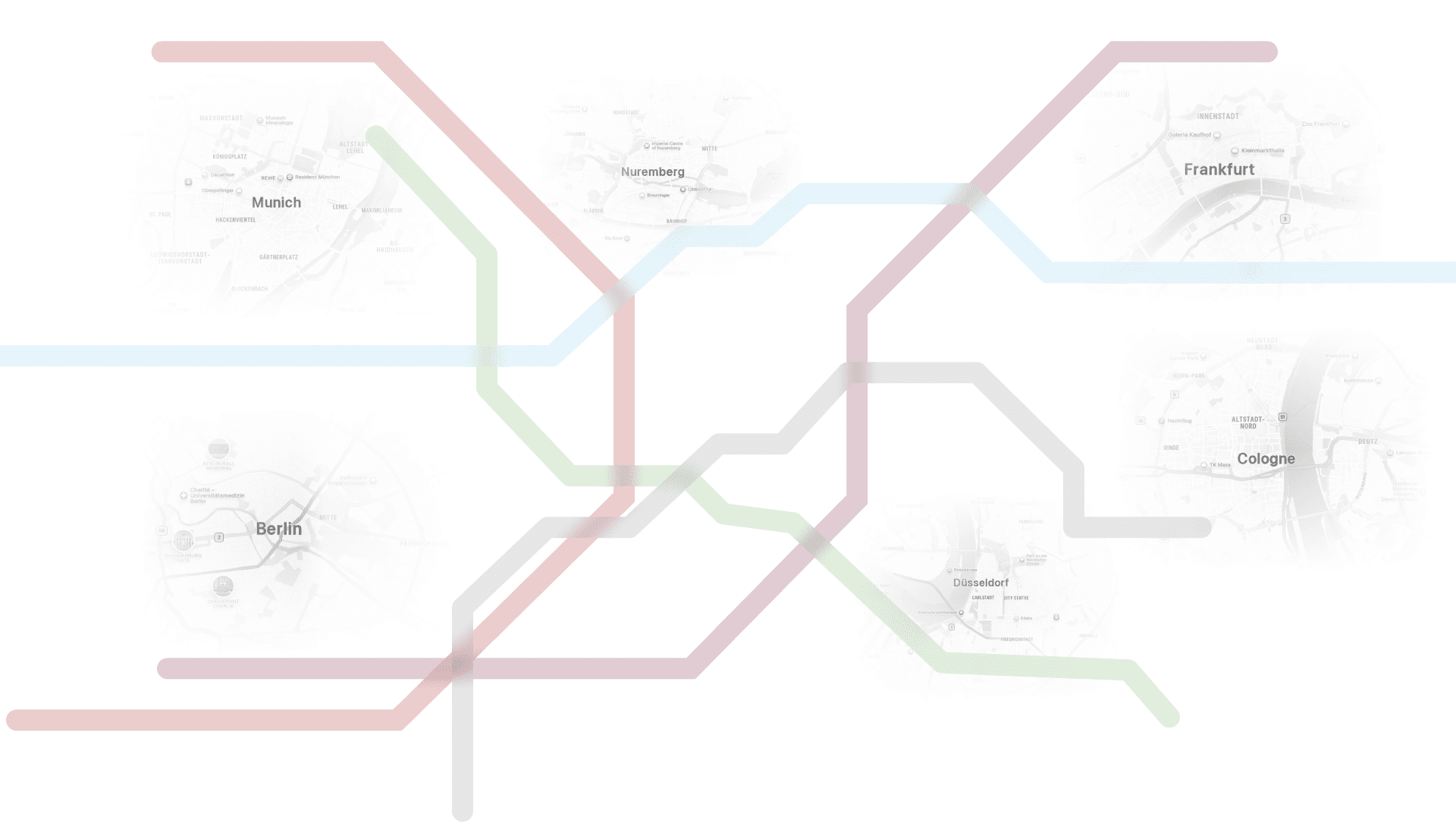

Appenzeller Str, Munich

Appenzeller Str, Munich